There is a theory of tort law that liability should be apportioned based on who could most efficiently have assured that a tortious event did not take place. If that standard were applied to the Bernie Madoff fiasco, the auditing profession would owe a whole lot of money to a whole lot of people. It’s a shame that the thoroughness, doggedness, and precision the profession is known for wasn’t applied to its own practitioners.

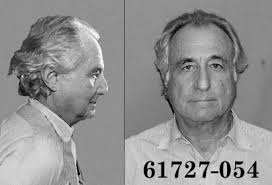

My nostalgia for this whole kerfuffle arises because after a six-month trial, a jury has just returned guilty verdicts against five of Madoff’s former employees. To understand why this event has raised unpleasant memories and unresolved concerns, let’s have a short Socratic dialogue: