Activity-Based Business Process Reengineering

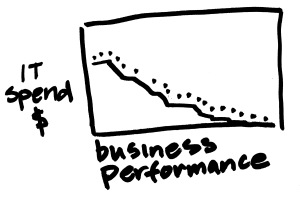

Consider the importance and magnitude of most business process reengineering projects. The time, the money, the systems, the consultants – usually driven by some compelling external or internal concern – an acquisition, a new product line, competition and a topsy-turvy market, the need to innovate or improve quality, to change the corporate culture, to simplify, to cut costs drastically. To transform the business.