The LTRO Bubble Has Popped, And Europe Is About To Find Itself In A World Of Trouble

The European Central Bank’s second and final 3-year, long-term refinancing operation has come and gone and while analysts are finalizing their bets on the take-up, they generally agree on one thing: The optimism is over.

The ECB’s massive liquidity operation has effectively removed the possibility of a banking crisis in the short term by averting a liquidity crisis and giving banks tons of cheap cash. Consequently, Spanish and Italian banks in particular purchased vast amounts of Italian and Spanish debt, as those bonds can be used as collateral against borrowing from the central bank.

That’s all been positive in the short run. In fact some optimists even suggested that this could bring an end to the crisis by relieving so much pressure off the banks.

But by now, everyone’s recognized that there are major flaws in this argument.

Italy and Spain

Italian and Spanish banks have borrowed from the ECB in record quantities and appear to have made sizable investments in domestic sovereign debt because they can make a profit off the difference between the interest rate on that debt and the one percent interest charged by the ECB.

This makes a lot of sense; if one of the countries were allowed to default, domestic banks would be dealing with complete economic collapse. Default on sovereign bonds would prove just a trivial piece of a much greater catastrophe.

In a closed economy, increasing domestic bank exposure to sovereign debt in order to pull an economy out of a trouble spot makes sense. So long as banks are there to buy up government debt, the government can issue as much debt as it wants and always find buyers. It can even give money to fund people and businesses and that excess money will eventually find its way back through the system as it’s pumped through the financial system via saving and lending.

Even in an economy with a single currency, currency risk will discourage (though not completely deter) investors (people, businesses, and banks) from putting money abroad.

The structure of the eurozone, however, completely eliminates this currency risk, and in fact encourages investors in one country to keep their money in another if its economic prospects are better. And despite currency risk, the prognosis for the euro area—and thus the euro—is so uncertain in the long term that many investors are willing to overlook the currency risk of holding American or Japanese assets because of the assurance that those investments will be worth something someday.

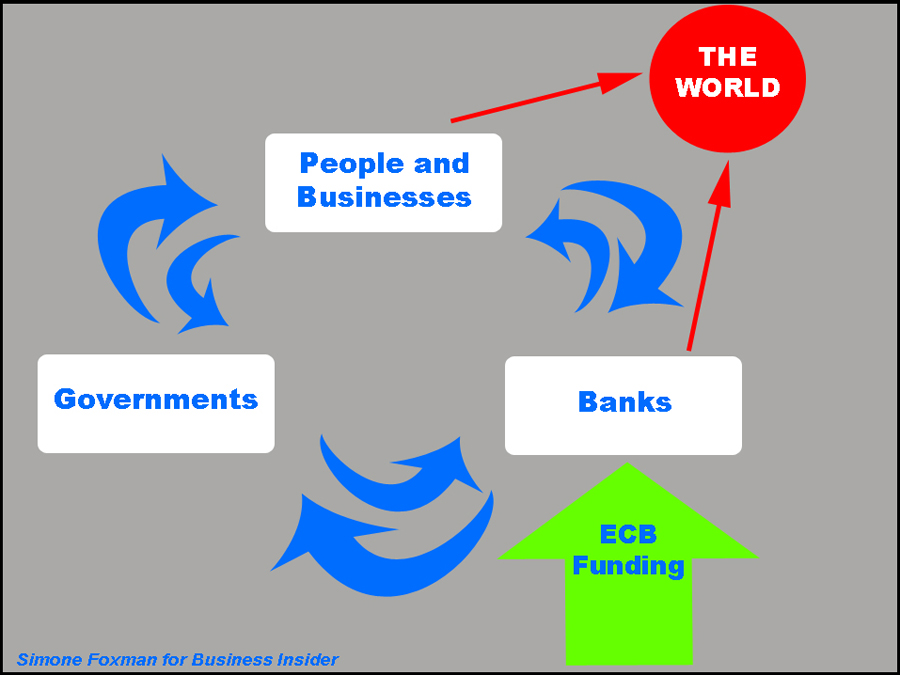

This chart illustrates what’s going on.

Simone Foxman for Business Insider

Where does all the money go?

But what if countries can grow out of it? you may ask. What if they can return to stability with more growth?

Pumping money into the banking system was indeed meant to propel stalling European economies, many of which were suffering because individuals and organizations were facing increasing difficulty in accessing money.

Again, in a closed economy, banks would have few options in how to use this cash. Perhaps they would store some money with the central bank or use it to beef up their cash reserves. But if the central bank is committed enough to such a program then this money will eventually make its way into the general economy through lending to people and businesses.

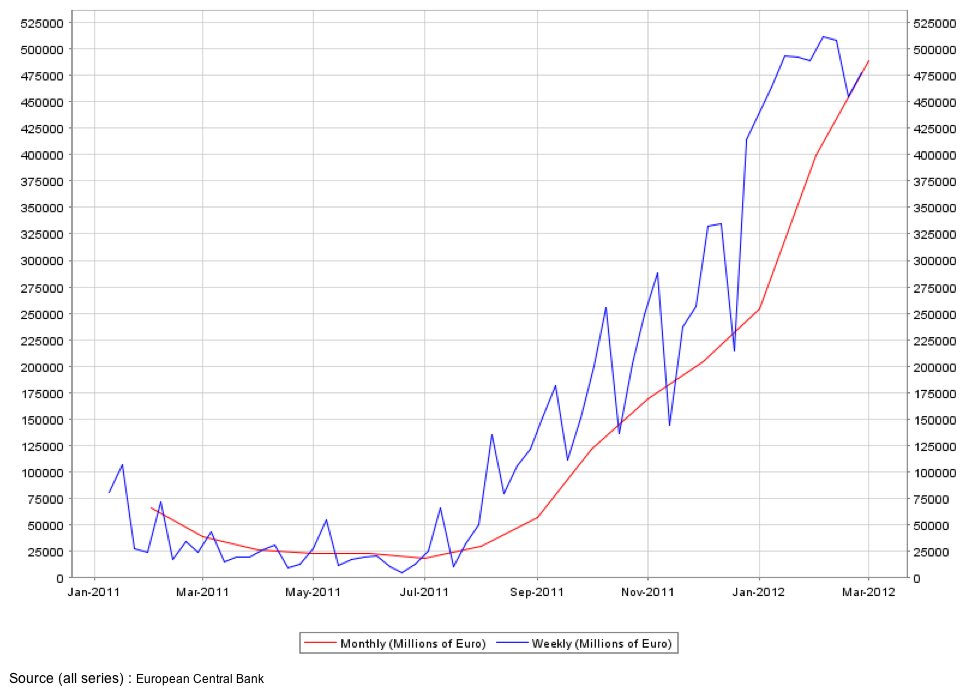

In most open economies, currency risk once again plays a factor, but in the euro zone, this isn’t a problem. First, European banks are so freaked out right now that a huge amount of money they’re borrowing from the ECB is just being stored again in the bank’s deposit facility. See the spike in deposits after the first LTRO on December 22:

European Central Bank

Second, since there’s no currency risk, there’s no reason that banks based in Spain or Italy wouldn’t choose investments in France or Germany over domestic ones. Thus, there’s no reason to believe that the money that is going back into the economy is being provided to domestic businesses.Is the banking crisis over?

Last but not least, some reports suggest that the benefit banks have reaped from the LTRO has not been sufficient to truly ward off bank funding problems in the medium term. While banks have cash in hand right now, new capital requirements as well as credit tightening driven by worries about the stability of peripheral European countries could once again increase pressures on banks.

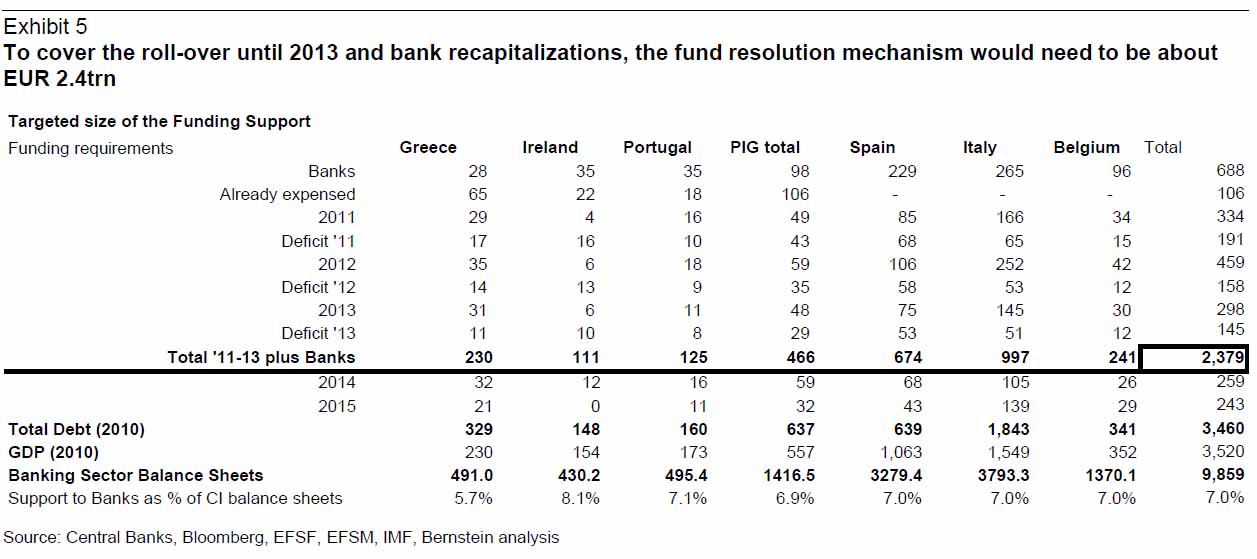

That’s scary, in part because European banks will need a lot more funding to take them through 2013. Essentially, this chart suggests that they would need the equivalent of 4 more LTROs to do so without help from the markets:

In sum, the LTRO was an excellent short-term move by the European Central Bank. Tomorrow’s funding operation will likely also prove a big success as banks are expected to borrow €400-500 billion more from the central bank.

However, if this truly is the last round of funding, then the effects of the LTRO will soon dissipate, and we’ll see renewed pressure on EU leaders to take more substantial action to address the debt crisis. And given their recent dithering, that may not be such a bad thing.

By Simone Foxman, from:Â http://www.businessinsider.com/the-ltro-bubble-has-popped-and-europe-is-about-to-find-itself-in-a-world-of-trouble-2012-2?op=1